In the dynamic world of property, one question that frequently arises for prospective investors is, “Is it a good time to buy a buy-to-let property?” The answer to this question depends on various factors, and making an informed decision requires a careful evaluation of your financial goals, market conditions, and investment strategy. Independent financial advice can be invaluable in helping you navigate this complex landscape.

At HL Financial, we understand that property investment can be a significant financial commitment, and we are here to guide you through the decision-making process. In this post, we will outline key considerations to help you determine whether now is the right time to invest in a buy-to-let property.

1. Is it cost-effective?

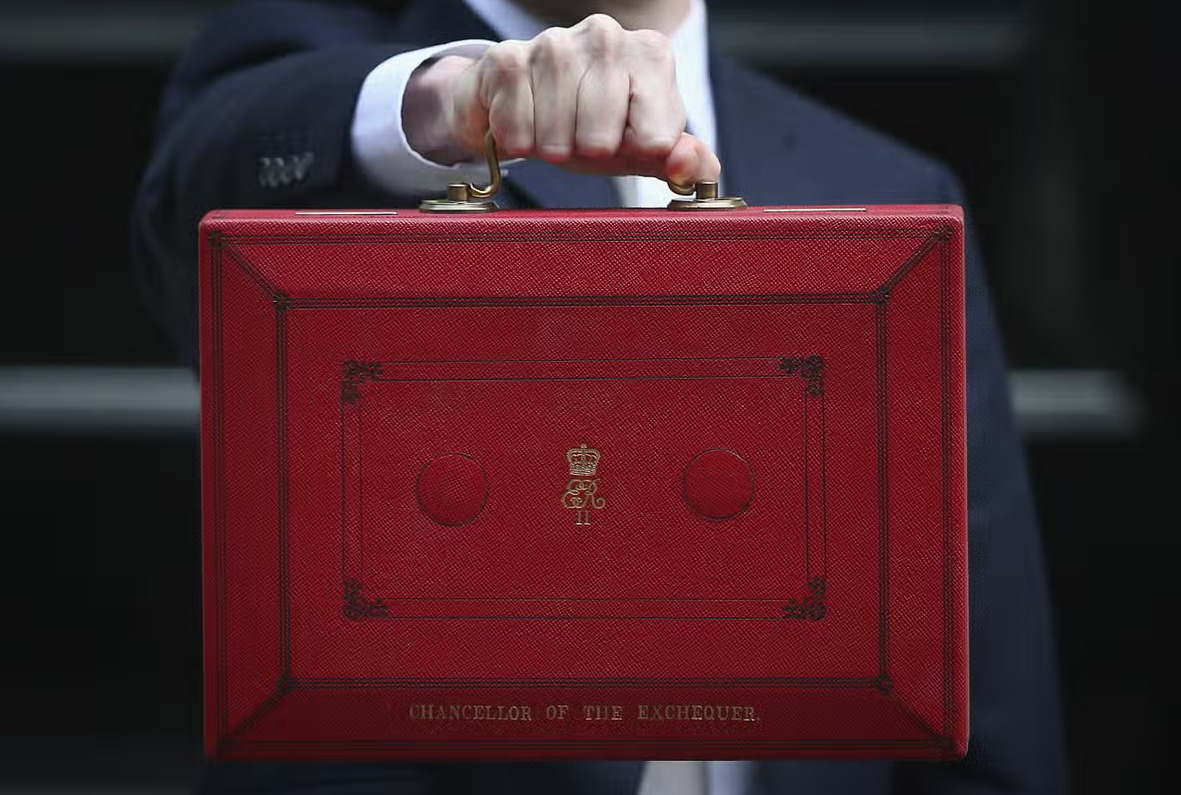

The first step in evaluating whether it’s a good time to buy a buy-to-let property is understanding the financial implications. This includes not only the purchase price of the property but also associated costs like stamp duty, legal fees, and ongoing expenses such as mortgage repayments, insurance, and property maintenance. HL Mortgages can assist you in calculating the costs, ensuring you have a clear picture of your financial commitment.

If you are looking to enter the investment property market now, it’s important to be mindful of changes in prices to understand if you are buying at a high or low valuation point.