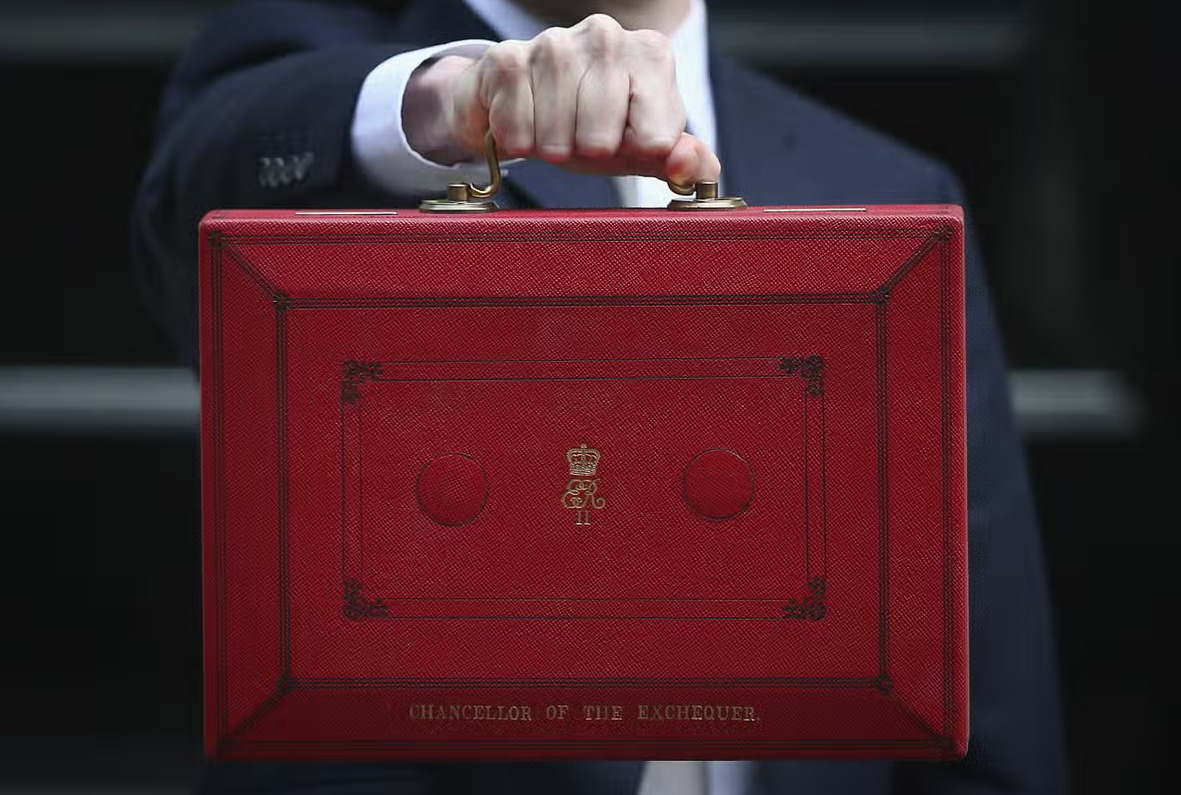

The Chancellor has unveiled a series of tax and spending policies that are set to shape the economic landscape in the coming years. Let’s dive into the key announcements and what they mean for businesses, individuals, and the overall economy.

Tax Adjustments:

National Insurance Cuts: Employees will see a reduction in their Class 1 National Insurance Contributions (NICs) from 12% to 10% starting January 6, 2024. Additionally, the main rate of Class 4 NICs for the self-employed will drop from 9% to 8% beginning April 6, 2024.

Capital Allowance Permanence: The “full expensing” capital allowance, allowing companies to deduct spending on new machinery and equipment from profits, has been made permanent. This move follows its temporary introduction in the 2023 Spring Budget.

Business Rates Relief: Eligible retail, hospitality, and leisure properties will benefit from an extension of the current 75% business rates relief for an additional year in 2024/25. The small business rates multiplier will also be frozen for the same period.

Freeports and Investment Zones: Tax reliefs for Freeports and Investment Zones have been extended from five to ten years, providing businesses with an extended window of financial benefits.

Alcohol Duties Freeze: Alcohol duties will be frozen until August 1, 2024, with the annual uprating decision delayed until the 2024 Spring Budget.

Welfare Reforms: The budget includes a comprehensive package of welfare reforms aimed at increasing employment. This involves strengthening work search requirements for certain individuals.