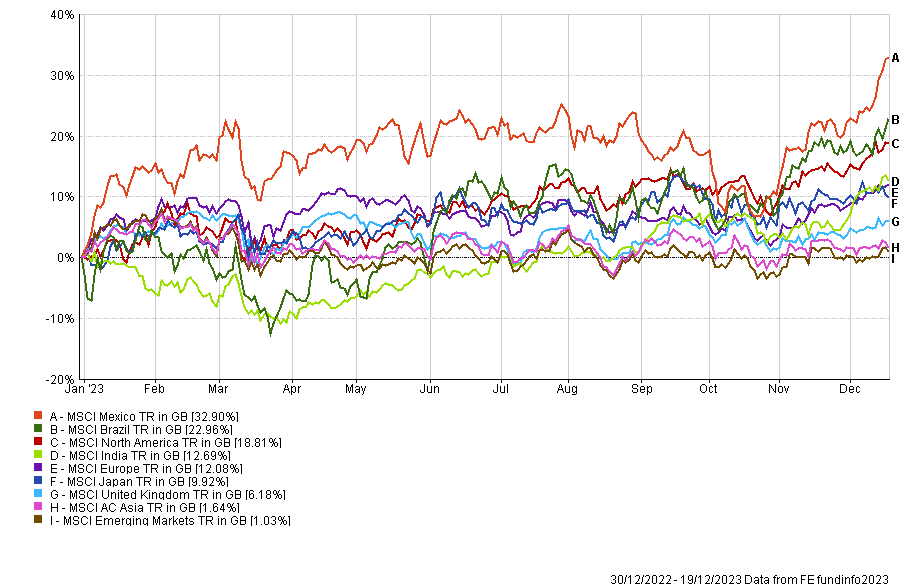

Different Geographical Winners and Losers

As we retreat from peak globalisation and enter a new era, there will be many more examples of governments and companies engaging with new partners to strengthen their supply chains. This will produce different winners and losers, but Latin America seems particularly well-placed to benefit, given the nature of the underlying economies.

At the other end of the scale is China, which, despite being the world’s second-largest economy is likely to continue losing out in some markets. Given the actions of the communist government in the last few years, it is considered unreliable and is often referred to by some American politicians as uninvestable. We would caution against writing China off, however, and the communist leadership know full well they have to manage a thriving economy if they are going to retain the support of the Chinese people.

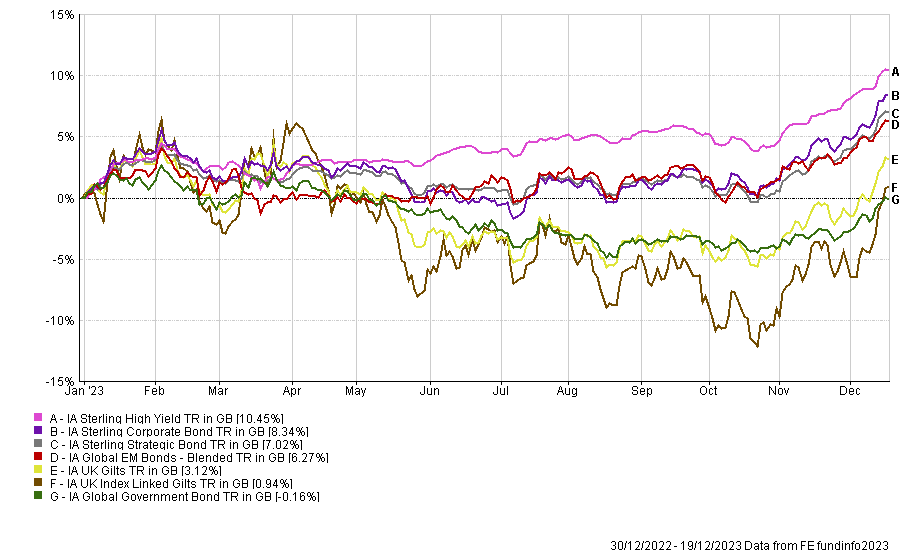

What Next for Fixed Interest?

As with equities, if we delve a little more deeply into the fixed interest (bond) markets (fig.3), we see the underlying sectors have performed very differently.

The UK’s index-linked market had been under relentless pressure since the central banks of the US, the Euro area and the Bank of England woke up to the realisation that inflation was not a temporary issue. The situation became more acute after the disastrous mini budget during the brief tenure of Liz Truss, but in recent weeks, the situation has started to turn around.

The UK high yield and emerging market debt markets, which are the riskiest sectors, have held up relatively well, as has the wider UK corporate bond sector, though admittedly from a low base.

Fixed Interest Sector Performance – 30/12/2022 to 19/12/2023 (fig 3) *